59

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2014

(Expressed in Barbados dollars)

49

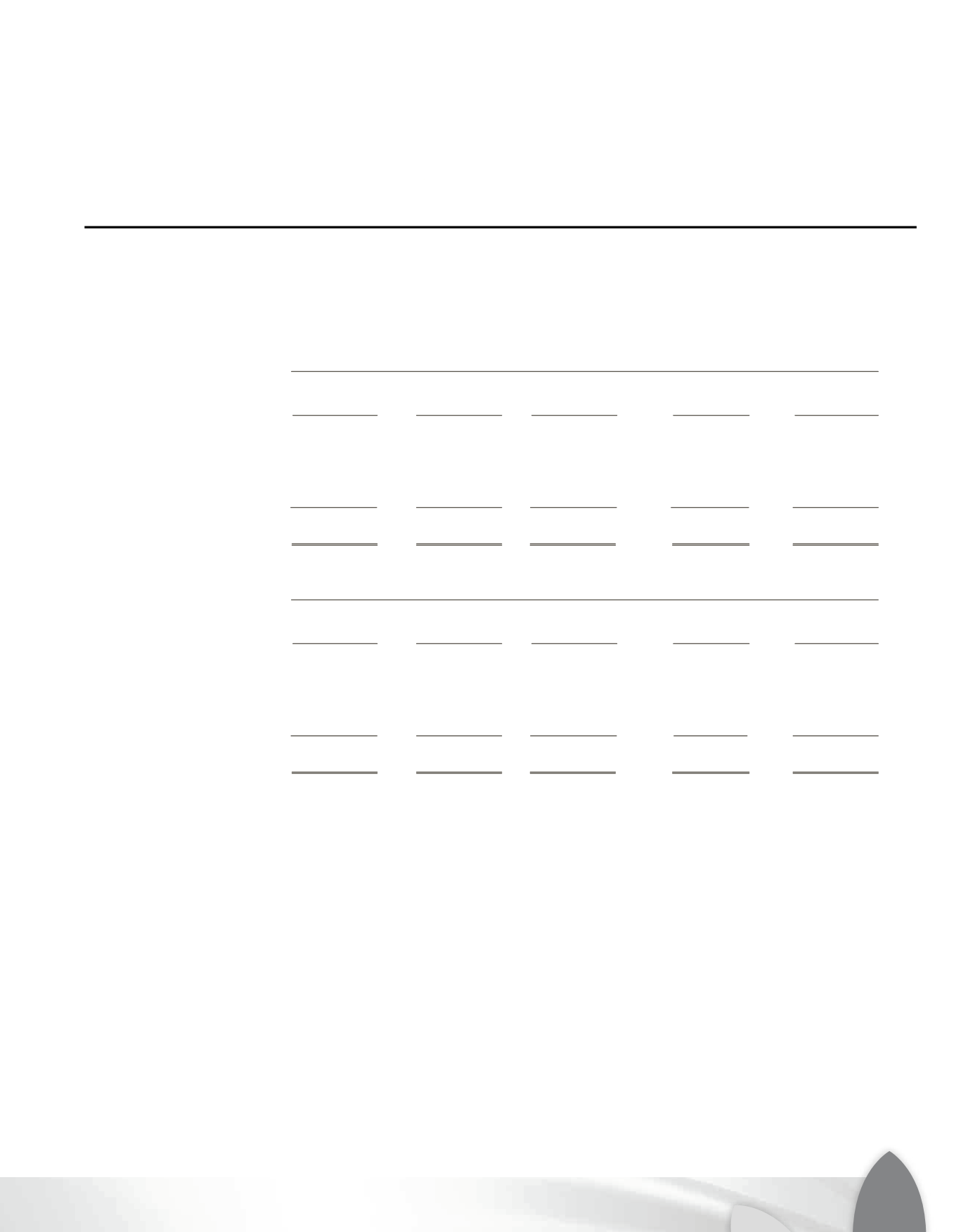

23. Financial Risk Management…(continued)

Liquidity risk and funding management...(continued)

Liquidity risk – Financial liabilities

2014

Within

Within

Within

Over

3 months

3-12 months

1-5 years

5 years

Deposits

$

437,551,212

43,336,394

254,423,149

57,825,354

Loans payable

5,023,152

3,996,839

22,730,389

29,383,545

Reimbursable shares

-

-

5,351,432

-

Other liabilities

-

5,424,060

-

2,543,327

$ 442,574,364

52,757,293

282,504,970

89,752,226

2013

Within

Within

Within

Over

3 months

3-12 months

1-5 years

5 years

Deposits

$

440,591,759

46,820,262

195,468,065

50,226,708

Loans payable

1,910,823

5,705,827

29,690,437

39,720,736

Reimbursable shares

-

-

5,726,048

-

Other liabilities

-

4,215,566

-

-

$ 442,502,582

56,741,655

230,884,550

89,947,444

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2014

(Expressed in Barbados dollars)

23. Financial Risk Management

.

Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due

to changes in market variables such as interest rates, foreign exchange rates and equity prices. The

Credit Union is mainly exposed to interest rate risk. The Credit Union’s exposure to currency risk is

minimal since it does not have any significant foreign currency denominated assets.

Interest rate risk

Interest rate risk is the risk of loss from the fluctuations in the future cash flows or fair values of

financial instruments because of a change in market interest rates. It arises when there is a mismatch

between interest-bearing assets and interest-bearing liabilities, which are subject to interest rate

adjustments, within a specified period. It can be reflected as a loss of future net interest income and/or

a loss of current market values.

2014

Within

Within

Within

Over

3 months

3-12 months 1-5 years

5 years

Total

Deposits $ 437,551,212

43,336,394 254,423,14

57,825,354

7 3,136,109

Loans paya le

5,023,152

3,996,839 22,730,389

29,383,54

61,133,925

Reimbursable shar

-

-

5,351,432

-

5,351,432

Other liabilities

-

7,967,387 -

-

7,967,387

$ 442,574,364 55,300,620 282,504,970

87,208,899

867,588,853

2013

Within

Within

Within

Over

3 months

3-12 months 1-5 years

5 years

Total

Deposits $ 440,591,759

46,820,262 195,468,065

50,226,708

733,106,794

Loans payable

1,910,823

5,705,827 29,690,437

39,720,736

77,027,823

Reimbursable shares

-

-

5,726,048

-

5,726,048

Other liabilities

-

4,215,566 -

-

4,215,566

$ 442,502,582 56,741,655 230,884,550

89,947,444

820,076,231