BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

64

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2014

(Expressed in Barbados dollars)

55

24. Fair Value...(continued)

Determination of fair value and fair value hierarchy

The Credit Union uses the following hierarchy for determining and disclosing the fair value of financial

instruments by valuation technique:

Level 1

: quoted (unadjusted) prices in active markets for identical assets or liabilities.

The fair value of financial instruments traded in active markets is based on quoted market prices at the

statement of financial position date. A market is regarded as active if quoted prices are readily and

regularly available from an exchange, dealer, broker, industry group, pricing service, or regulatory

agency, and those prices represent actual and regularly occurring market transactions on an arm’s

length basis. The quoted market price used for financial assets held by the Credit Union is the current

bid price. These instruments are included in Level 1.

Level 2

: other techniques for which all inputs which have a significant effect on the recorded fair value

are observable, either directly or indirectly.

The fair value of financial instruments that are not traded in an active market (for example, over-the-

counter derivatives) is determined by using valuation techniques. These valuation techniques

maximise the use of observable market data where it is available and rely as little as possible on entity

specific estimates. If all significant inputs required to fair value an instrument are observable, the

instrument is included in Level 2.

Level 3

: techniques which use inputs which have a significant effect on the recorded fair value that are

not based on observable market data.

If one or more of the significant inputs is not based on observable market data, the instrument is

included in Level 3.

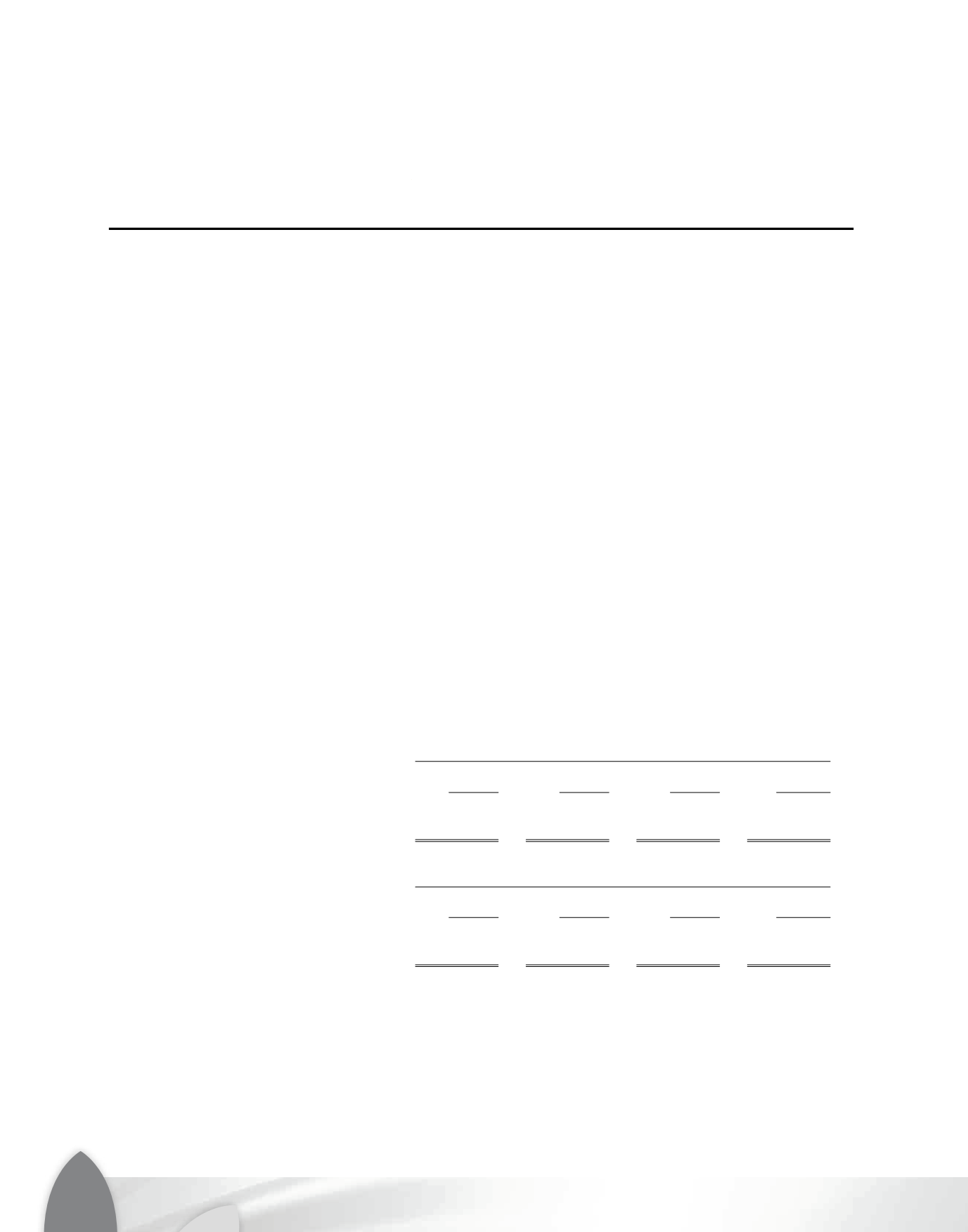

The following table presents the Credit Union’s financial instruments that are measured at fair value.

2014

Total

Level 1

Level 2

Level 3

balance

Investment securities

Available-for-sale

- Equity securities

$ 1,290,000

-

664,348

1,954,348

2013

Total

Level 1

Level 2

Level 3

balance

Investment securities

Available-for-sale

- Equity securities

$ 1,250,000

-

604,710

1,854,710