65

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

BARBADOS PUBLIC WORKERS' CO-OPERATIVE CREDIT UNION LIMITED

Notes to the Non-consolidated Financial Statements

For the year ended March 31, 2014

(Expressed in Barbados dollars)

56

24. Fair Value...(continued)

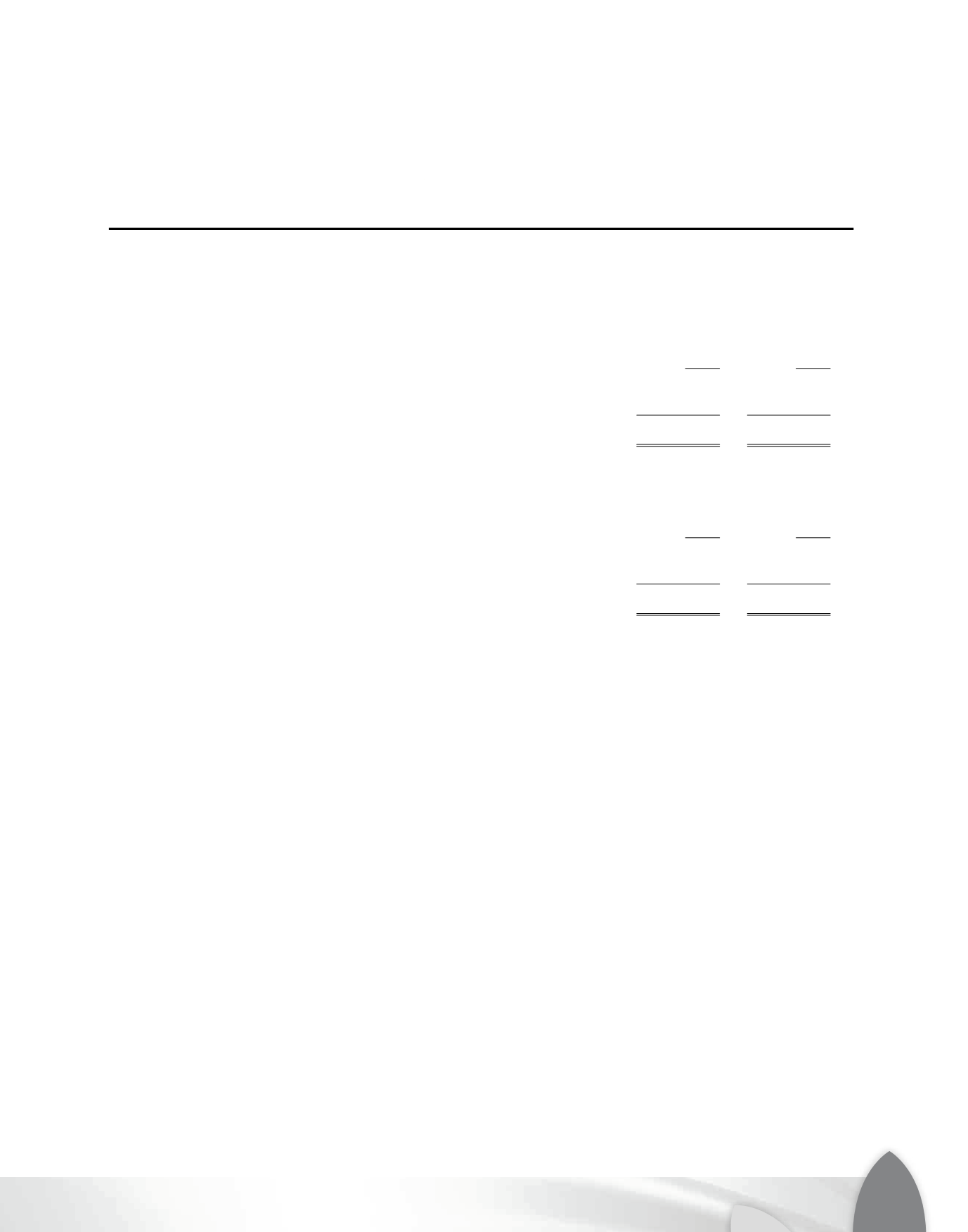

The following table shows a reconciliation of all movements in the fair value of financial investments

categorized within Level 1 between the beginning and end of the reporting period.

2014

2013

Balance - beginning of year

$

1,250,000

1,345,000

Unrealised gain/(loss)

40,000

(95,000)

Balance - end of year

$ 1,290,000

1,250,000

The following table shows a reconciliation of all movements in the fair value of financial investments

categorized within Level 3 between the beginning and end of the reporting period.

2014

2013

Balance - beginning of year

$

604,710

594,000

Purchases

59,638

10,710

Balance - end of year

$

664,348

604,710

There were no transfers in or out of Level 3 during the year ended March 31, 2014 (2013: nil).

The financial investments classified as Level 3 securities are carried at cost as fair value cannot be

reliably estimated. Therefore no significant unobservable inputs have been considered in determining

its value. The application of sensitivity analysis is therefore not relevant.

25. Capital Management

The Credit Union’s objectives when managing capital, which is a broader concept than the ‘equity’ on

the face of the statement of financial position, are:

•

To comply with the capital requirements set by the regulators of financial institutions where the

Credit Union operates;

•

To safeguard the Credit Union’s ability to continue as a going concern so that it can continue to

provide returns to its shareholders and benefits to other stakeholders; and

•

To maintain a strong capital base to support the development of its business.