9

BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

MANAGEMENT DISCUSSION AND ANALYSIS

expenses increased by $2.0 million or 13.6 percent above prior

year.

OPERATING LEASES

Rent expenses increased for the year ending March 31, 2014

moving from $172 thousand in 2013 to $286 thousand in

2014. This increase was directly attributed to expansions of

the Credit Union’s branch operations at the Six Roads location

as well as the establishment of a new branch at Carlton & A1

in Black Rock, St. Michael.

STAFF COSTS

During the year, the Credit Union increased its staff complement

to strengthen its member services, financial reporting and risk

management functions as well as providing human resources

for its branch expansions.

In addition, contractual salary increases as well as higher

pension plan expenses also contributed to the increases in staff

costs.

TOTAL EXPENSES

Total expenses for the year under review amounted to $31.3

million, which represents an increase of $4.0 million or 14.6

percent above prior year.

NET OPERATING INCOME

Net operating income inclusive of loan impairment expenses

increased by $2.4 million or 6.2 percent, to end the year at

$41.7 million. Loan impairment expense was $4.4 million, a

decline of $381 thousand or 7.9 percent below prior year.

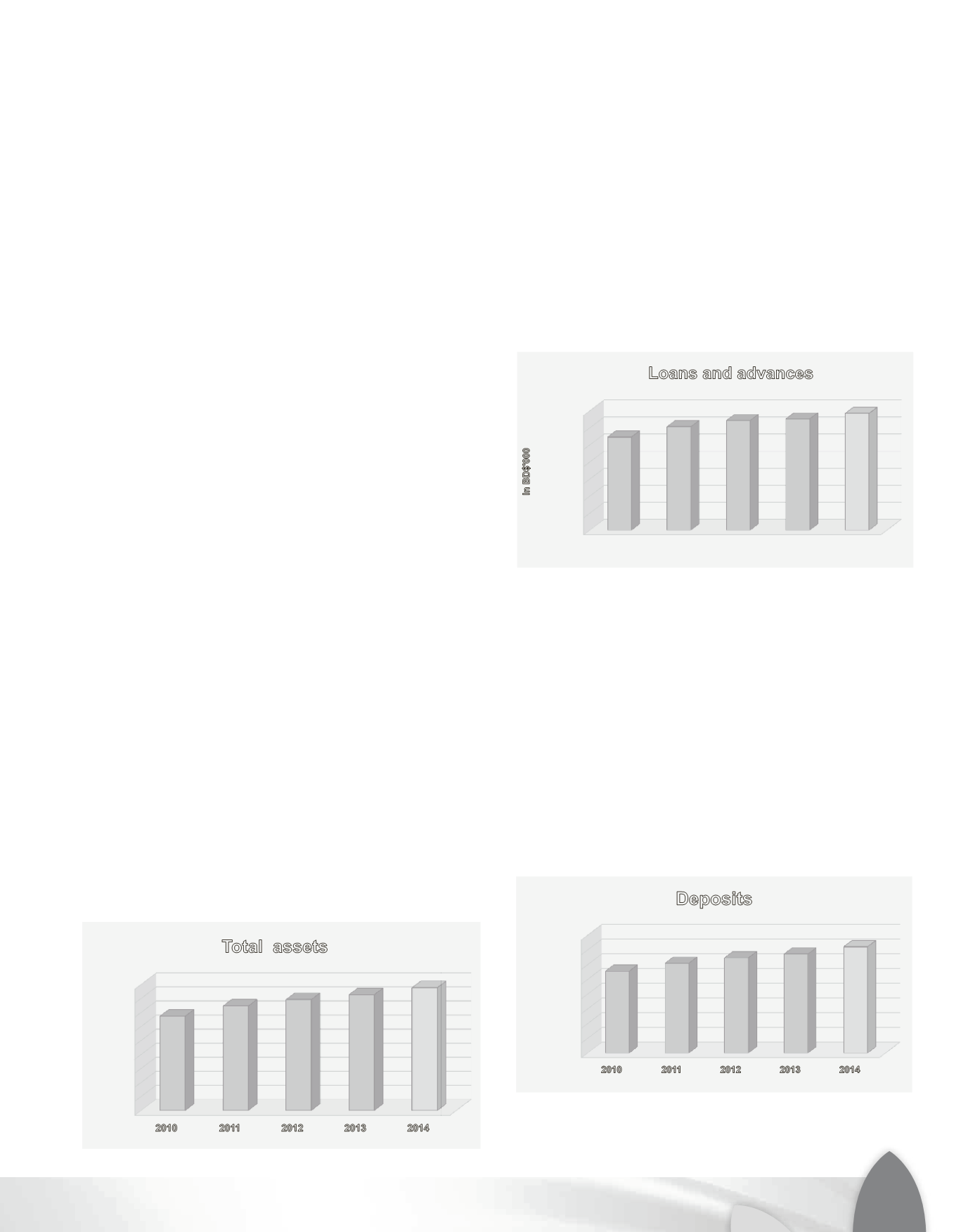

ASSETS

At year-end the Credit Union’s asset base amounted to $876.6

million, an increase of $49.8 million or 6.0 percent. During

the financial year ending March 31, 2014 cash resources

decreased by $1.0 million or 0.9 percent. In addition, financial

investments classified as Held-to-maturity increased by $4.0

million or 24.5 percent.

At the end of the financial year, the net loans and advances

rose to $684.3 million, inclusive of an impairment provision of

$21.3 million, as compared to $651.9 million and $19.6 million

respectively at the end of the previous year. Consumer loans

were the major engine of loan growth during the year.

ASSET QUALITY

Amid a climate of uncertainty and high job losses, the Credit

Union recorded a decrease of 1.1 percent in its delinquency

ratio which ended the year at 6.6 percent compared to prior

year which was 7.7 percent.

In addition, impaired loans decreased by $4.6 million during

the 2014 financial year as compared to an increase of $5.8

million in the prior year. The Credit Union will continue to

work diligently with defaulters to offer them alternatives and

restructuring plans to enable them to restore their loans to a

state of normalcy.

In addition, support systems have been set up to help those

members who recently lost their jobs due to the on-going

retrenchment exercise in the public sector.

LIABILITIES

Deposits totaled $721.8 million and were $49.4 million or 7.3

percent higher than at the previous year-end.

Loans payable were reduced during the year to $43.7 million

from $55.4 million as a result of amounts of $11.7 million being

0

100

,

000

200

,

000

300

,

000

400

,

000

500

,

000

600

,

000

700

,

000

800

,

000

900

,

000

2010

2011

2012

2013

2014

672

,

887

745

,

571

791

,

851

826

,

845

876

,

592

In BD$'000

Total assets

0

100

,

000

200

,

000

300

,

000

400

,

000

500

,

000

600

,

000

700

,

000

2010

2011

2012

2013

2014

545

,

488

606

,

515

642

,

797

651

,

868

684

,

331

In BD$'000

Loans and advances

0

100

,

000

200

,

000

300

,

000

400

,

000

500

,

000

600

,

000

700

,

000

800

,

000

2010

2011

2012

2013

2014

556

,

123

609

,

705

646

,

435

672

,

403

721

,

76

7

In BD$'000

Deposits

0

1

,

000

200

,

000

300

,

000

400

,

000

500

,

000

60

,

000

7

,

000

2010

2011

012

2013

2014

545

,

488

606

,

515

642

,

797

651

,

868

684

,

331

In BD$'000

Loans and advances

0

100

,

000

200

,

000

300

,

000

400

,

000

500

,

000

600

,

000

700

,

000

800

,

000

2010

2011

2012

2013

2014

556

,

123

609

,

705

646

,

435

672

,

403

721

,

76

7

In BD$'000

Deposits