BARBADOS PUBLIC WORKERS’ CO-OPERATIVE CREDIT UNION LIMITED

NON-CONSOLIDATED ANNUAL REPORT 2014

8

growth when compared to prior year. Loans grew by $32.5

million or 5.0 percent in 2014 as compared to prior year when

loans grew by $9.1 million or 1.4 percent.

NET INTEREST INCOME

Net interest income grew by $2.5 million or 6.1 percent in

2014. Total interest income grew by $2.8 million or 4.4 percent

while total interest expense increased by $321 thousand or

1.4 percent. Interest income increased by $2.7 million or 4.4

percent in respect of interest from loans while interest from

cash deposits and investments increased by $153 thousand or

4.1 percent during 2014.

OTHER INCOME

Other income declined by $484 thousand or 16.7 percent

during the financial year 2014 mainly due to loss of rental

income from rental of the Clarence Greenidge Building.

However, other income from value added services grew by

$199 thousand or 22.0 percent.

EFFICIENCY AND EXPENSE MANAGEMENT

The Credit Union’s strategy during the 2014 financial year

was one which focused heavily on efficiency and expense

management while at the same time adding valued customer

service. However, growth necessitated an increase in operating

expenses as we sought to recover market share thus operating

MANAGEMENT DISCUSSION AND ANALYSIS

This section of the Annual Report provides a discussion and

analysis of the financial condition and performance of the

Barbados Public Workers’ Co-operative Credit Union Limited

(BPWCCUL) for the financial year ended March 31, 2014 as

compared to the prior financial year, ended March 31, 2013.

ECONOMIC REVIEW

The global economy is still feeling the effects of the 2008-2009

recession.

Barbados’ sovereign rating was downgraded to a non-

investment grade by Moody’s and Standard & Poor’s in 2012 and

again by two notches (to Ba3 and BB- respectively) in December

2013. These actions were predicated on deteriorating growth

prospects, inadequate policies and fiscal imbalances.

In the local economy, activity is estimated to have fallen

by 0.4 percent during the first quarter of 2014. Last year

unemployment in Barbados stood at approximately 12 percent,

but this rate is forecast to rise as the government retrenchment

programme continues.

OVERVIEW

These are challenging times for the Credit Union movement as

the government has proposed that credit unions pay 0.2 percent

tax on its assets starting June 1, 2014. This is in addition to the

challenge of having more of its members being unemployed as

a result of the current retrenchment programme. However, the

Barbados Public Workers’ Co-operative Credit Union Limited

will be ever vigilant in seeking out opportunities for its members

so as to improve their social, financial and economic well-being.

During the year under review, the Credit Union continued

to grow in key aspects of its operations. New membership

averaged 333 per month and recorded net growth of 3,999

for the year ending March 31, 2014. Deposits grew by $49.4

million or 7.3 percent together with assets which grew by $49.7

million or 6.0 percent.

The Credit Union’s on-going efforts to mitigate and reduce the

level of delinquent loans have resulted in the delinquency rate

being 6.6 percent at March 31, 2014 compared to 7.7 percent

at March 31, 2013.

REVIEW OF FINANCIAL PERFORMANCE

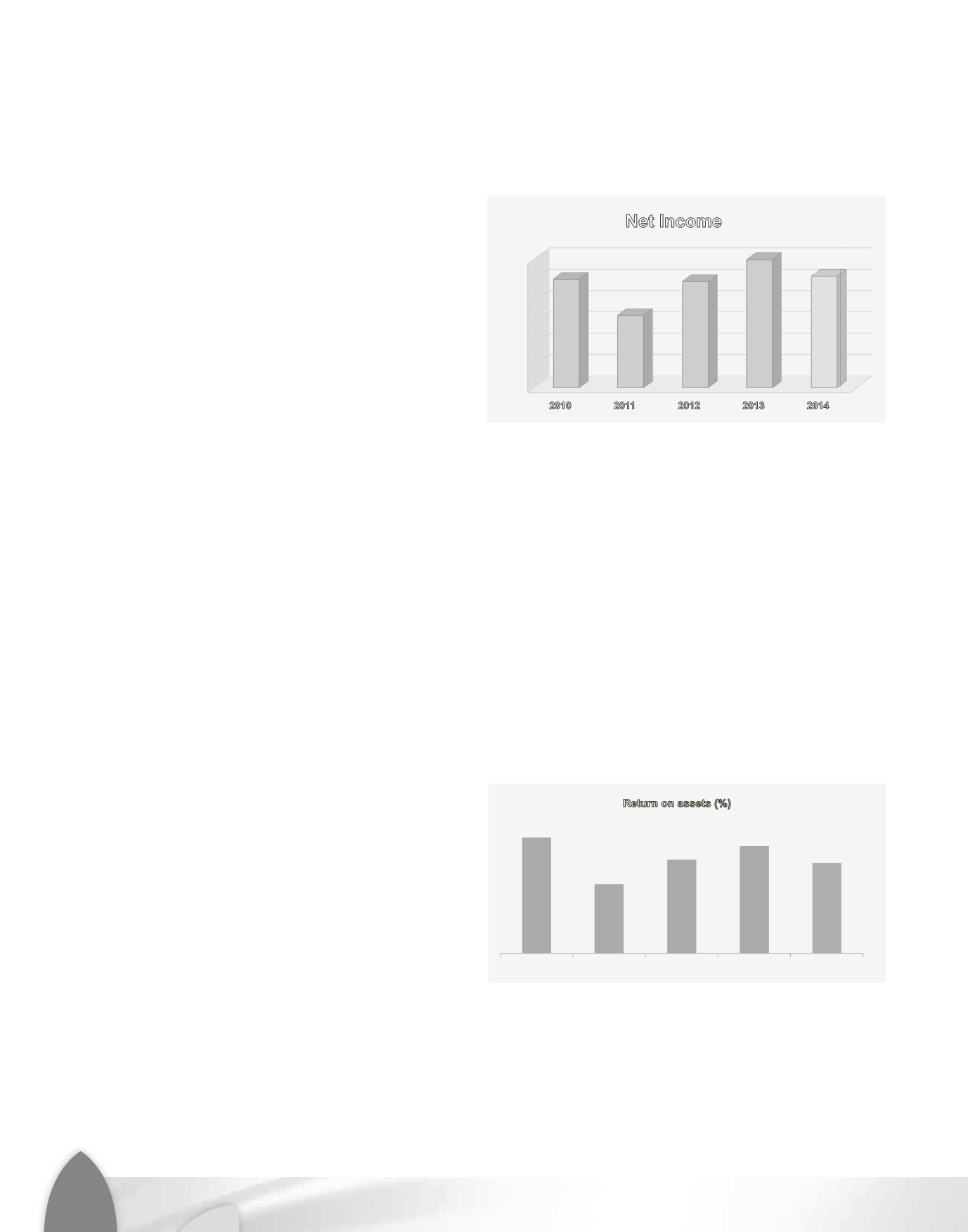

TOTAL INCOME AND NET INCOME

Net income for 2014 was $10.4 million compared to $12.0

million in the prior year. Total revenue grew by $2.4 million

in 2014 moving from $67.5 million in 2013 to $69.9 million

during the 2014 financial year.

The credit environment remained challenging in 2014.

However, the Credit Union achieved a commendable net loan

2010

2011

2012

2013

Return on assets

1.60 0.96 1.29 1.48

2010

2011

2012

2013

Return on equity

17.25 10.17 13.38 14.29

Return on equity is a key measure of profitability.

Retun on assets

It is calculated a net income expressed as a percentage

It is calculated a

of average equity

1.60

0.96

1.29

1.48

1.22

2010

2011

2012

2013

2014

Return on assets (%)

17.25

10.17

13.38

14.29

11.36

2010

2011

2012

2013

2014

Return on equity (%)

0

100

,

000

200

,

000

300

,

000

400

,

000

500

,

000

600

,

000

2010

2011

2012

2013

2014

In BD$'000

0

2

,

000

4

,

000

6

,

000

8

,

000

10

,

000

12

,

000

2010

2011

2012

2 13

2014

10

,

175

6

,

791

9

,

939

11

,

993

10

,

427

In BD$'000

Net Income